Choose the services

Decide or consult on the best resume writing services you need, upload your old resume, or fill up the express form to ensure your assigned Writer has all the necessary details of your professional background.

Check on progress

Cooperate with your certified resume Writer to develop your career summary, make changes, and endorse the content.

Get your resume!

Find two formats of your professional resume (DOCX and PDF) and open the door to your career opportunities by applying for a new job immediately.

Our Packages

Having years of experience in the recruiting, we know exactly what details to focus on and how to create the appropriate content. Invest in your career!

Professionally written keywords-optimized and error-free Resume

Personalized Cover Letter

LinkedIn Profile .doc version

Targeted e-Cover Letter

Customized and tailored Thank you and Follow-Up letters

With this package you also get:

Two versions: .doc for ATS scanning and .pdf for printing purposes

Modern and ATS compatible design

Unlimited revisions within 45 days

Communication with your writer via emails at any time

Professionally written keywords-optimized and error-free Resume

Personalized Cover Letter

LinkedIn Profile .doc version

Targeted e-Cover Letter

Customized and tailored Thank you and Follow-Up letters

With this package you also get:

Two versions: .doc for ATS scanning and .pdf for printing purposes

Modern and ATS compatible design

Unlimited revisions within 45 days

Communication with your writer via emails at any time

Professionally written keywords-optimized and error-free Resume

Personalized Cover Letter

LinkedIn Profile .doc version

Targeted e-Cover Letter

Customized and tailored Thank you and Follow-Up letters

With this package you also get:

Two versions: .doc for ATS scanning and .pdf for printing purposes

Modern and ATS compatible design

Unlimited revisions within 45 days

Communication with your writer via emails at any time

Our Writers

Get a free resume review from our writers

Subscribe to our newsletter

Get $15 discount on your first order!

"I ordered the Advanced package. All three documents were sent two days earlier which is super great. And the quality is far better than I would have done. Thank you, ResumeGets team!"

"I've gotten so many responses since updating my resume. I was able to update my LinkedIn as well. Thank you again"

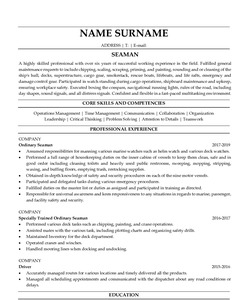

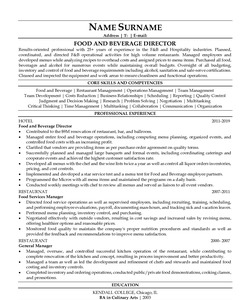

Best Resume Examples

View allResumeGets, Our Professional Resume Writing Service, Has Already Provided Numerous Impeccable Resumes That Have Helped Individuals Secure More Job Interviews And Get Hired Faster.

We are ResumeGets, a team of resume writing experts!

If you find it challenging to organize your thoughts while writing your resume or CV and, thus, delay applying for a new job, if you have doubts about the accuracy of the information and structure of your resume, or, perhaps, writing your employment papers overwhelms you, and you're feeling stressed due to a lack of time for proper formatting and formulating, entrust our resume writing service with helping you get the best resume for your job search needs.

ResumeGets can take care of all of these possible concerns and difficulties, so you can rest assured that you're in good hands.

While there are so many free recommendations available online for creating CVs/Resumes, they can often be controversial. If you're unfamiliar with resume writing services, it's the ideal time to discover the valuable benefits ours offers. Here are some of the features that make us stand out:

- You will have a personal Resume Writing Manager who will communicate with you to ensure efficient order completion.

- Our resume writing service offers a Support Team that promptly responds to any urgent questions or concerns you may have. You can reach out to us via chat, phone, or email.

- You can expect prompt order completion, with the updated resume reflecting your unique qualities. While we handle urgent tasks, we recommend placing an order in advance, just in case you want to make any updates or edits.

- We offer resume formatting and ATS optimization, including keywords matching your profession.

- We offer free revisions if you're not satisfied with the first versions. Simply share your vision and let us know the changes you'd like to make.

- We create 100% original content to make your resume stand out from others.

- We understand the difficulties of developing a Federal Resume and offer well-constructed, detail-oriented files that meet the requirements for federal government jobs.

- ResumeGets is compliant with the General Data Protection Regulation. We do not share any personal information or payment details with third parties. Our website uses a Secure Sockets Layer certificate to provide an additional layer of security against hacker attacks. Your data is always kept safe for your convenience.

Is It OK to Order a Resume Online?

Writing a well-tailored and error-free resume is one of the most critical parts of a job search process that can accelerate your success in finding one. However, if it is not written correctly, recruiters can reject it, or it can even fail to pass ATS software scanning. The ATS system filters resumes based on criteria like keywords, years of experience, skills, and layout, which many applicants are not familiar with. This leads to their resumes not being considered by Human Resource Managers. To overcome this, job seekers are increasingly turning to online resume writing services for professional assistance in landing more interviews and getting hired faster.

A well-crafted resume can significantly impact your career advancement and income. ResumeGets is a leading certified resume writing service that can help bring your individual career story to life and boost your career. With our help, you can get a perfect resume and get hired faster.

ResumeGets – A Proven Resume Writing Service

Our agency provides top-notch resume writing and consulting services for job seekers actively seeking new employment opportunities. Over the years, we have satisfied countless clients who have reached out to us for resume preparation assistance, resulting in a 96.5% hiring success rate. Our customer-centric approach and commitment to excellence have made us a leading resume writing service for over six years. Besides, we offer several free features that you can take advantage of, including formatting, revisions, drafts, and ATS optimization.

Order Your New Resume Now!

Our team of resume writing experts is well-versed in the demands of recruiters and strives to create a resume that will increase your chances of landing an interview. As a reasonably priced resume writing service, ResumeGets has helped over 828,000 satisfied customers. We take our responsibility to produce high-quality content and optimize resumes seriously. We understand that many people find it challenging to write job application documents, so don't waste any more time and order your resume online today.

Our resume tips blog

View all tipsResume vs. CV: Understanding the Key Differences and When...

November 2, 2023

Finding the Perfect Fit: Choosing Countries for Remote Em...

October 18, 2023

Know When to Stop: Test Tasks in the Job Hunt

October 5, 2023

Workation: A New Trend or a Solution for the Modern Profe...

September 27, 2023

Should You Add Your Old Jobs From 20 Years Ago To Your Re...

September 15, 2023

Work-Life Balance - Harmonize Your Routine

September 5, 2023

Popular Categories

- 5 Executive Core Qualifications Review

- CV editing service

- IT resume writing services

- Buy resume

- Career change cover letter

- Career change resume

- Certified resume writers

- Cheap resume writing service

- Check your resume

- Cover Letter Writing Service

- Curriculum vitae writing

- Engineering resume writing

- Fix my resume

- Free resume review

- Help with resume wording

- Hire resume writer

- Legal resume writing service

- LinkedIn profile writing

- Resume assistance

- Resume editing services

- Resume preparation

- Resume rewrite service

- Resume services near me

- Resume writers

- Resume writing services

- Write my resume